Integrated Facilities Management Sector: A Beacon of Stability In Uncertain Times

To glean insights from a detailed deck and participate in Company Engineering’s live bidding campaign, click here to access all details through CapBridge.

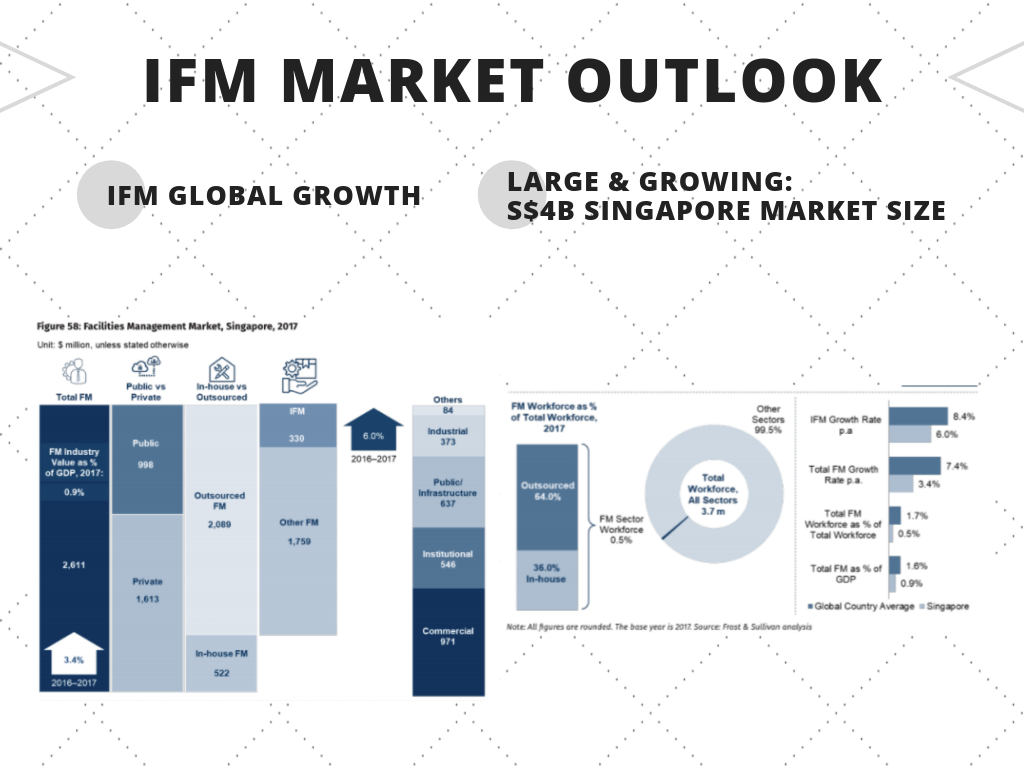

Integrated Facilities Management (“IFM”) is the consolidation of a building’s services within a single contract. IFM is expected to grow at a CAGR of 11.8% from 2017 to 2026, translating to a threefold growth in revenue generation from USD 30.11B to USD 91.92B.[1] In Singapore, the public sector contributes 37.5% of the IFM market, equating to SGD 1.5B. Government tenders include those from the Ministry of Education, Home Affairs and the Land Transport Authority (“LTA”). The prevalence of IFM within our shores is evident in its increasing value as a % of our GDP, which stood at 0.9% as of 2017, an uptick of 0.9% from the previous year. Accordingly, IFM employs a larger percentage of Singapore’s total workforce, rising at a per annum rate of 8.4%.[2]

IFM Trends and Drivers

Within the Asia Pacific, there is a growing demand for sophisticated offerings in mature. Stringent regulatory requirements and increased competition pressure companies to source for vendors that can deliver and manage facilities services. Typically, mature markets with higher outsourcing penetration experience higher demand for integrated solutions.[3] An example of this is Singapore, where outsourced facilities management grossly outweighs in-house services by almost four times.

Another factor spurring the IFM market is an observed spike in the number of international contracts heralded by a country’s strategic location and level of development lead to company woes. These include demand for simplification and standardization of services[4], such as those related to the functionality of a built environment. Outsourcing IFM is the natural solution, thereby supporting the above trend which culminates in the growth of market size.

A Closer Look at Company Engineering

Strong track records are pivotal in order for a company to win contracts in the public sector. Company Engineering is one company that secured key IFM projects with governmental and government-affiliated bodies like JTC Corporation and Tan Tock Seng Hospital. This has boded well for the Company Engineering as evidenced by its well-established revenue growth track record that is diversified across IFM and ITS segments.

Another determinant as to whether a company will win future contracts is shaped by Government spending and policies. LTA announced infrastructure development projects which could amount to over SGD 137M in project pipeline for Company Engineering. Their proprietary technologies span over a range of infrastructure service offerings. Coupled with past successes in the international scene alongside higher global spending, Company Engineering is primed to capture both domestic and international markets.

[1] Facility Management Services – Global Market Outlook (2017-2026). (2018, April). Retrieved from https://www.researchandmarkets.com/reports/4562537/facility-management-services-global-market

[2] (2018). Global FM Market Report 2018. Retrieved from https://www.iwfm.org.uk/sites/default/files/2019-01/24315 Global FM Market Report 2017_0.pdf

[3] Sullivan, F. &. (2019, February 25). Opportunities and Outlook for IFM Companies in APAC, 2018. Retrieved from https://ww2.frost.com/frost-perspectives/opportunities-and-outlook-for-ifm-companies-in-apac-2018/

[4] The 4 key trends driving growth in the Facility Management industry. Retrieved from https://www.servicefutures.com/the-4-key-trends-driving-growth-in-the-facility-management-industry